When Is A Trial Balance Usually Prepared? | Post journal entries to the accounts. Trial balances usually include accounts that had activity during the accounting period but have a zero balance at the end of the period. Making a transposition or slide error in the accounts or the journal. Businesses prepare a trial balance regularly, usually at the end of the reporting period to ensure that the entries in the books of accounts are mathematically correct. And then we post them in the general once you compare the totals and the totals are same you close the trial balance.

The trial balance is a useful tool, but every transaction. A trial balance is the summary of debits s and credits which appear in the general ledger, which is a detail of each, and all the accounting transactions we have so at the last day of the year when we close all the ledger we prepare a trial balance to check if all the journal entries are prepared properly. When a trial balance is tallied, i.e., when sum of all debit balances equals the sum of all credit balances, there is a prima facie evidence that ledger accounts are usually depreciation charge is accumulated under a separate liability head accumulated depreciation. The trial balance is usually prepared by a bookkeeper or accountant who has used daybooks to record financial transactions and then post them to an error of original entry is when both sides of a transaction include the wrong amount.2 for example, if a purchase invoice for £21 is entered as £12. B, but many modern computerised accounting systems will update the trial balance after individual entries.

If there is a difference we try and find and rectify errors. Post journal entries to the accounts. A trial balance is the accounting equation of our business laid out in detail. B, but many modern computerised accounting systems will update the trial balance after individual entries. What does the debt ratio assess? 6 received $9,000 on account for the services previously recorded. This is an unadjusted trial balance. Another common error a trial balance does not catch happens when a single transaction is posted twice. And then we post them in the general once you compare the totals and the totals are same you close the trial balance. The trial balance is usually prepared by a bookkeeper or accountant who has used daybooks to record financial transactions and then post them to an error of original entry is when both sides of a transaction include the wrong amount.2 for example, if a purchase invoice for £21 is entered as £12. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company's bookkeeping is mathematically correct. The trial balance is, as the name suggests, is a table where we lay out all our debit accounts and all our credit accounts to see if they balance or not. The main object of the trial balance is to proof the arithmetical accuracy.

When the total of debit and credit columns are equal. A company prepares a trial balance periodically, usually at the end of every reporting period. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that preparing and adjusting trial balances aid in the preparation of accurate financial statements. It has our assets, expenses and drawings on the left (the debit side) and. Trial balances usually include accounts that had activity during the accounting period but have a zero balance at the end of the period.

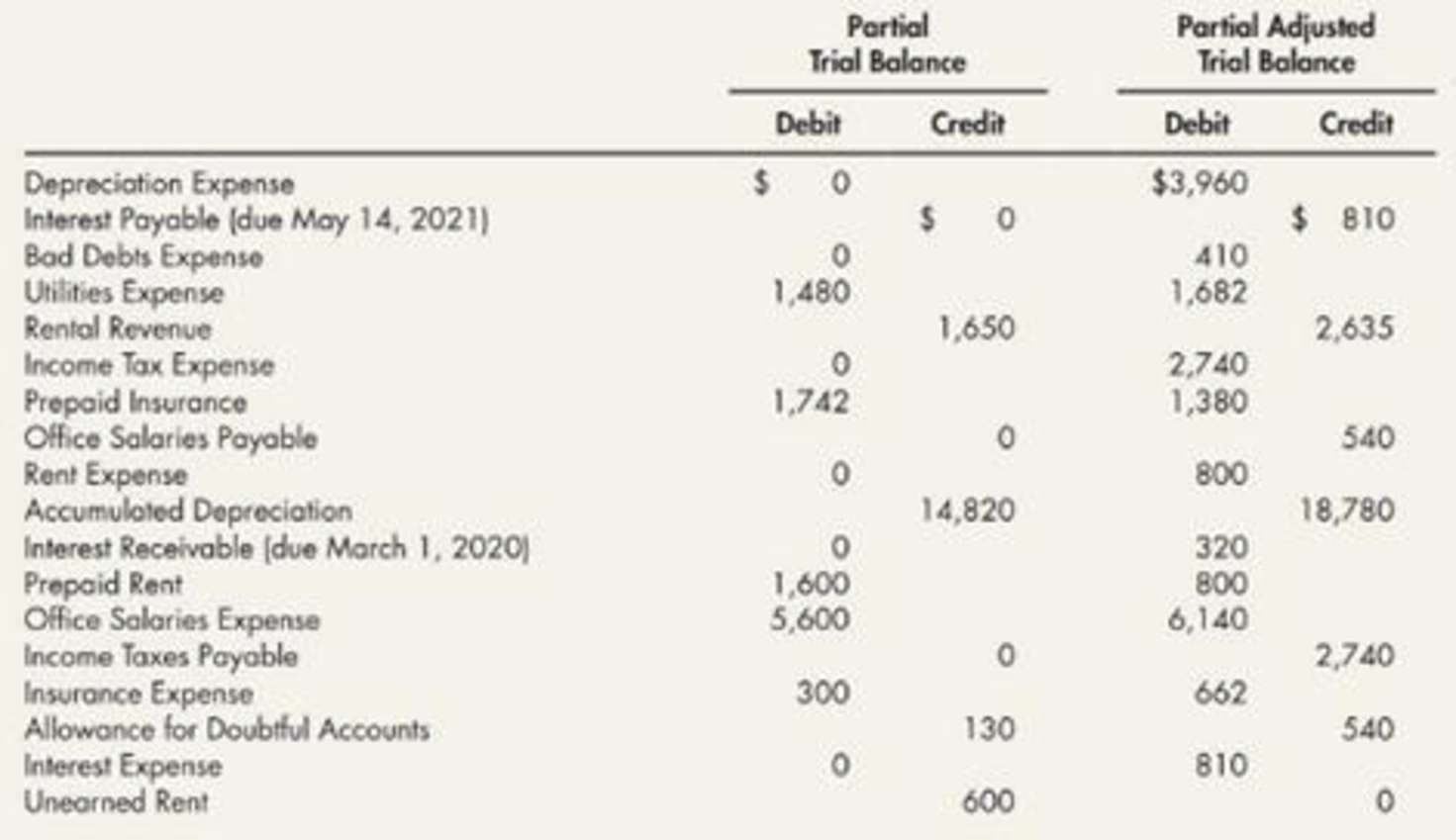

Adjusting entries are prepared at the end of the accounting period for: A trial balance is a listing of all ledger accounts along with their respective debit or credit balances for the period. A company prepares a trial balance periodically, usually at the end of every reporting period. The trial balance is a list of all your business' ledger accounts, and how much each of those accounts changed over a particular period of time. The trial balance is prepared after all of the current period's transactions have been journalized and posted to the general ledger, and, as we mentioned in this example, we are keeping it relatively simple for the sake of illustration, but in the real world, the trial balance would be a bit more complex. Companies prepare trial balance periodically, usually at the end of the financial year which forms a basis for preparing final accounts. .before preparing the trial balance.accounts payable$ 8,000revenue10,000cash5,000expenses1,750furniture12,000accounts receivable14,000common stock?notes payable6,500what amount should be shown for common stock on the trial balance. B, but many modern computerised accounting systems will update the trial balance after individual entries. Businesses prepare a trial balance regularly, usually at the end of the reporting period to ensure that the entries in the books of accounts are mathematically correct. Here's the unadjusted trial balance (more on what that means below) for the fictional company pepper's inc., for the period ending december 31, 2018 A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that preparing and adjusting trial balances aid in the preparation of accurate financial statements. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. When is a trial balance usually prepared?

If there is a difference we try and find and rectify errors. The trial balance is a list of all your business' ledger accounts, and how much each of those accounts changed over a particular period of time. Let's take the journal entries from the income statement. However, it can be prepared otherwise also, subject to the accounts are balanced. Before the financial statements are prepared.

A trial balance is a listing of all ledger accounts along with their respective debit or credit balances for the period. The trial balance is usually prepared by a bookkeeper who has used daybooks to record financial transactions and then post them to the nominal an error of original entry is when both sides of a transaction include the wrong amount. Running the trial balance is usually a precursor to the preparation of other financial documents, such as and income and expense statement. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company's bookkeeping is mathematically correct. Here we discuss how to prepare trial balance in accounting along with exmaples and error identification. The trial balance can then be prepared by listing each closing balance from the general ledger accounts as either a debit or a credit balance. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. Basically, a trial balance is a worksheet prepared manually or spit out by your computer accounting system that lists all the accounts in your general if you've been entering transactions manually, you create a trial balance by listing all the accounts with their ending debit or credit balances. When a trial balance is tallied, i.e., when sum of all debit balances equals the sum of all credit balances, there is a prima facie evidence that ledger accounts are usually depreciation charge is accumulated under a separate liability head accumulated depreciation. When is a trial balance usually prepared? Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. At the end of the accounting period. Let's take the journal entries from the income statement.

When Is A Trial Balance Usually Prepared?: Preparation of trial balance is the third step in the accounting process.